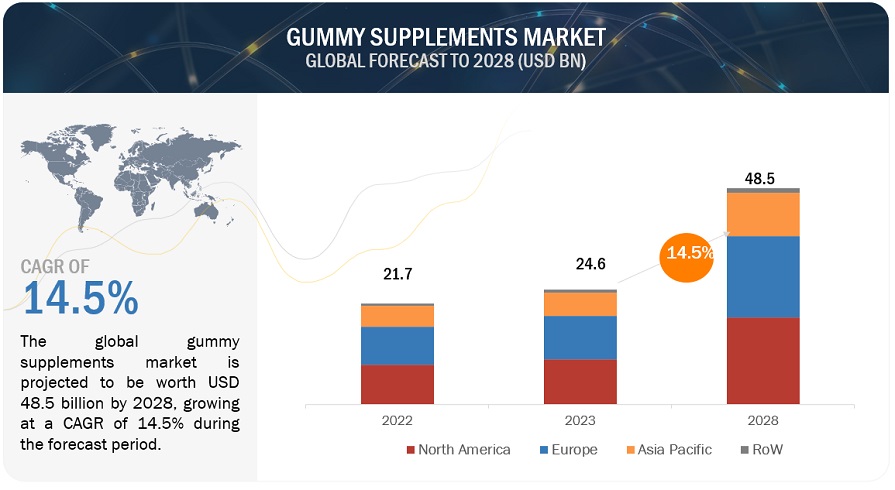

According to a research report "Gummy Supplements Market by Type (Vitamin Gummies, Omega Fatty Acid Gummies, Collagen Gummies, CBD Gummies), Starch Ingredient (Supplements With Starch, Starchless Systems), Distribution Channel, End User, Functionality Region - Global Forecast to 2028" published by MarketsandMarkets, the global Gummy supplement market is projected to reach USD 48.5 billion by 2028 from USD 24.6 billion by 2023, at a CAGR of 14.5% during the forecast period in terms of value. The World Health Organization (WHO) estimates that more than two billion people worldwide suffer from micronutrient insufficiency. Iron, vitamin A, and iodine deficiencies are the most prevalent worldwide, particularly in youngsters and pregnant women. Micronutrient deficits are disproportionately prevalent in low- and middle-income counties. Micronutrient deficiencies can induce evident and serious health issues, but they can also produce less clinically noticeable decreases in energy, mental clarity, and overall capacity. This may result in poorer academic performance, decreased productivity at work, and a higher chance of contracting other illnesses and medical disorders. A lot of these inadequacies can be avoided by taking supplements. Thus, consumers are gradually adopting gummy supplements which provide the required number of vitamins, minerals, and other micronutrients in a convenient and tasteful form.

Download PDF Brochure @ https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=39376426

Vitamin gummies segment is anticipated to have the largest share among gummy types in 2023

The global market for gummy vitamins is currently experiencing tremendous growth. Gummy vitamins typically have delicious fruity flavors and all the necessary micronutrients. Therefore, a lot of individuals choose gummy vitamins over conventional vitamins, especially kids and elder people who have problems swallowing tablets. In the upcoming years, the nutraceutical business is expected to see a significant increase in sales of vitamin gummies. Working-class consumers who seek to balance health factors like folic acid, metabolic health, and glycemic index in an effort to address problems like bone strength, immunity, and vitamin deficiencies will also contribute significantly in the expansion of the gummy supplements market.

The kids segment is projected to grow at the fastest rate among all the other end-users in the Gummy Supplements market in 2023

Gummy supplements have grown in popularity as a convenient way to provide kids with the vitamins and minerals they require without having to consume a range of foods. Gummy supplements meet the changing demands of children. They supply comprehensive nourishment in an uncomplicated way to the kids. They are superior to normal vitamins and more appealing to capture kids' interest and make them easier to ingest. Unlike tablets or pills, gummies are easier for kids to swallow since they are shaped like sweets. Additionally, according to the scientific article titled “Intraindividual double burden of overweight and micronutrient deficiencies or anemia among preschool children”, published in 2020, an estimated 29% of preschool children worldwide are vitamin A deficient, 18% are anemic, and 17% are at danger of low zinc intake. Thus, the soaring rates of micronutrient deficiencies can be reduced with the help of gummy supplements, augmenting its market growth.

Make an Inquiry @

https://www.marketsandmarkets.com/Enquiry_Before_BuyingNew.asp?id=39376426

North America region is witnessing the highest growth rate in the Gummy Supplements market

According to a 2022 report from the American Psychological Association, financial troubles, along with a deluge of horrible visuals from Ukraine as Russia, have pushed a majority of Americans to new levels of stress. Hence, although immunity gummies are increasingly popular in the US after the pandemic, interest in gummies that assist mental health and sleep has also been rising.

Additionally, according to the CDC, the prevalence of metabolic syndrome is estimated at more than 30% in the United States Thus, A vitamin, mineral, or supplement product is normally taken by more than three out of every four Americans to maintain their health. Considering gummies are the most convenient and flavorful form of supplements providing a variety of functionality, the market is rapidly flourishing in this region.