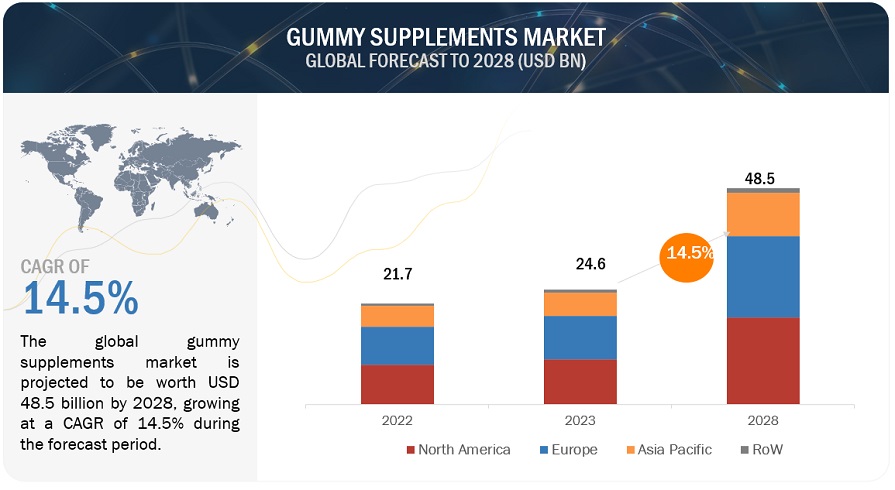

The gummy supplements marketis projected to reach USD 48.5 billion by 2028 growing at a CAGR of 14.5% from 2023 to 2028. An increase in diseases, disposable incomes, and awareness of fortified food products is driving the gummy supplements market. The chewy texture of gummies is a distinctive feature that appeals to individuals of all age groups, making them an attractive product for consumption. Gummies are a tasty and enjoyable delight to eat because of their appealing soft, spongy texture. Gummies are a simple and portable supplement option because they are frequently provided in small, sealed packets or containers. They are a well-liked option for time-pressed consumers searching for a quick and delectable treat because they are simple to transport and enjoy when traveling.

Download PDF Brochure:

https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=39376426

Based on type, the gummy supplements market is segmented into vitamin gummies, omega fatty acid gummies, collagen gummies, CBD gummies, and other types. Vitamin gummies have been so popular and have high demand as customers can select the precise vitamins and minerals, they require from a variety of vitamin gummy combinations. They come in multivitamin formulations as well as formulations for certain vitamins like Vitamin C, Vitamin D, etc.

By distribution channel, the online retail stores segment is anticipated to witness the fastest growth during the forecast period. More gummy supplements can be found on e-commerce platforms than at conventional retailers. Different brands, recipes, and flavors are available for consumers to compare and select from with ease. Customers may get gummy supplements whenever they want, regardless of store hours, thanks to the availability of online purchasing platforms around-the-clock. Consumers can readily compare prices from many merchants using e-commerce platforms, which may help in their search for the best offer.

By end user, the adults segment is projected to exhibit the fastest growth among all the other end users. According to the Health Survey for England 2021, 25.9% of adults in England are suffering from obesity and 37.9% of the population is under the overweight category. As gummy supplements such as fiber-containing gummies can help in weight management, the demand is likely to increase during the forecast period. To tap this growing market companies like Unilever (UK), Nestle (Switzerland), etc. have included fiber gummies in their product portfolio.

Based on region, North America is the leading region across all other regions for the gummy supplements market in 2023, with the US being the largest market in the region. According to the National Center for Health Statistics (NCHS) 2021, in the US, the prevalence of obesity was 41.9% from 2017 to March 2020. Gummies can be a great option for consumers who are looking for weight management. This will boost the demand for gummy supplements in the US. Not only obesity, but Americans are also suffering from various vitamin deficiencies, all these factors will drive the gummy supplements market.

Request Sample Pages:

https://www.marketsandmarkets.com/requestsampleNew.asp?id=39376426

The key players in the gummy supplements market include GSK Pplc (UK), Haleon Group of Companies (UK), Church Dwight Co., Inc. (US), Amway (US), Bayer AG (Germany), Nestle (Switzerland), Unilever (UK), and Otsuka Pharmaceutical Co., Ltd. (Japan). The key strategies the leading market players adopted include new product launches, mergers, partnerships, and expansions. For instance, in November 2020, Unilever acquired Smartypants a U.S.‐based Vitamin, Mineral Supplement company.