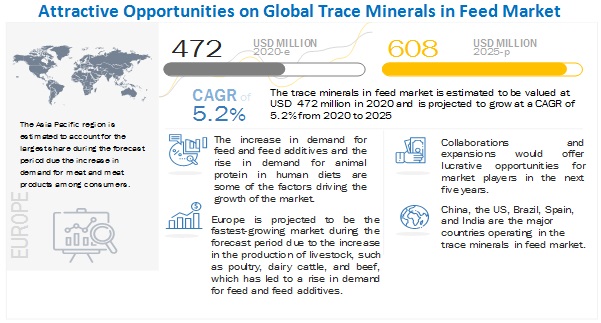

The global trace minerals in feed market size is estimated to be valued USD 472 million in 2020 and is expected to reach a value of USD 608 million by 2025, growing at a CAGR of 5.2% during the forecast period. Factors such as increasing demand for polutry, changing consumer preferences due to fast-paced lifestyles, and increased need for high protein sources in food products is driving the market for Trace minerals in feed during the forecast period.

Download PDF Brochure @

https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=196308436

https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=196308436

Key players in this market include Cargill, Incorporated (US), Koninklijke DSM N.V. (Netherlands), Archer Daniels Midland Company (US), Novus International (US), and Kemin Industries, Inc. (US), Zinpro Corporation (US), Alltech (US), Tanke (China), Global Animal Products (US), Orffa (Netherlands), BASF SE (Germany), Bluestar Adisseo (China), JH Biotech, Inc. (US), and Virbac (France).

Expansions and collaborations were the key strategies adopted by the leading players in the Trace minerals in feed market with a view to improve their product line and presence in the market.

Cargill, Incorporated (US) operates through food, agriculture, and financial and industrial products and services. The company provides a vast range of trace mineral products through its animal nutrition segment for beef cattle, dairy cattle, goats, swine, and horses. Furthermore, Cargill offers many animal nutrition products under its famous brands, such as Provimi, Purina, Diamond V, and Nutrena, which deliver essential trace minerals required in feed products to improve their health.

Cargill has 17 innovation and application centers across the globe that focus on the development of animal nutrition products and new methods to maximize feed conversion and improve animal performance. The company focuses on undertaking strategies, such as investments and partnerships, to expand the feed and nutrition business. For instance, the acquisition of Pro-Pet (France) in 2018 and partnership with InnovaFeed (France) helped it meet the nutritional needs of the growing livestock population. The global COVID-19 pandemic has led to an increase in consumer demand across the globe. However, the company has been successful in quickly adjusting its manufacturing operations and supply chains to help customers deliver food products to places where it is increasingly required. In the US, Cargill partnered with a restaurant chain to divert 90 million shell eggs to retail stores, while in Canada, it quickly re-packaged 4,000 cases of chicken breast originally intended for fast-food sandwiches to fill grocery store shelves.

Archer-Daniels-Midland Company (ADM) (US) is one of the major suppliers and manufactueres of animal nutrition products. ADM is addressing this demand by providing a wide range of innovative products for the animal nutrition market. We work closely with customers, universities and nutrition experts to research, develop, and create high-quality animal nutrition products. ADM’s product offerings range from amino acids and feed enzymes to high-quality macro feed ingredients, supplements, premixes, custom ingredient blends and specialty feed ingredients to aid in optimizing animal health and nutrition.

ADM is a member of more than 200 business and trade associations in the company that has its presence in more than 200 countries across the globe, 330 food and feed ingredient manufacturing facilities, 62 innovation centers, and the world’s premier crop transportation network. It mainly focuses on undertaking research and expansion strategies. For instance, in 2019, ADM opened its new livestock feed plant in Vietnam and acquired Neovia (US), an animal nutrition company, to expand its geographic reach and efficiently serve consumers around the world. Archer Daniels Midland Company (ADM) has recently comleted the acquisition of Neovia, which is also a major player in the animal nutrition industry.

BASF SE (Germany) operates through six segments, which include chemicals, materials, industrial solutions, surface technologies, nutrition & care, and agricultural solutions. It provides a range of trace minerals for feed products through its animal nutrition segment. It has a strong focus on undertaking innovation and development. The BASF Group comprises subsidiaries and joint ventures in more than 80 countries and operates in six integrated production sites and 390 other production sites in Europe, Asia, Australia, the Americas, and Africa. BASF has customers in over 190 countries and supplies products to various industries. In animal nutrition, enzymes are used predominantly for monogastric animals such as pigs and poultry. BASF enzymes are added to feed, indigestible feed components so that they can be digested in the gastrointestinal tract. This means that the animals consume less feed and grow better, which is reflected in better efficiency.

Speak to Analyst @ https://www.marketsandmarkets.com/speaktoanalystNew.asp?id=196308436

The trace minerals in feed market is estimated to grow significantly in the Asia Pacific region due to the rise in demand for poultry meat and poultry byproducts as well as ruminants from the major economies such as China, India, Japan, and other South East Asian countries as they experience a surge in the increase in number of health -conscious consumers. The increase in awareness amongst consumers about the essential nutrients requirement in daily diet, have increased the demand for protein rich meat. In Asia Pacific, trends around healthy lifestyles and prevention among older consumers trying to avoid expensive healthcare costs and extend healthy lifespans are generating growth opportunities dietary supplements. Thus, causing Trace minerals in feed to flourish in the region.