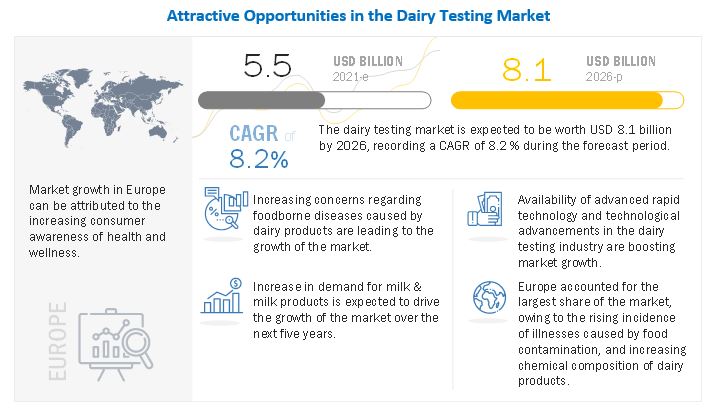

The dairy testing market is expected to experience substantial growth in the coming years, with a projected value of USD 8.1 billion by 2026 and a CAGR of 8.2%. This market was estimated to be worth USD 5.5 billion in 2021. Food testing includes all types of foods from plant and animal sources. Dairy testing is an application in food testing that deals with the safety and quality of milk and other dairy products.

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=240885146

According to Food and Agriculture Organization (US), more than six billion people worldwide consume milk and dairy products. Testing plays an important role in ensuring that end consumers have access to safe and high-quality milk and dairy products free from harmful pathogens, heavy metals, dioxins, and adulterants. Dairy testing also helps manufacturers adhere to regulatory requirements for permissible limits of contaminants, labeling laws, prevention of fraudulent practices, and avert incidents of foodborne diseases, toxicity, or poisoning.

Opportunities : Technological advancements in testing industry

The focus on reducing lead time, sample utilization, cost of testing, and drawbacks associated with several technologies have resulted in the development of new technologies in spectrometry and chromatography. The wide-scale adoption of these technologies provides an opportunity for medium- and small-scale laboratories to expand their service offerings and compete with large market players in the industry, as these technologies offer benefits such as higher sensitivity, accurate results, reliability, multi-contaminant, and non-targeted screening with low turnaround time.

The dairy testing market is witnessing several technological innovations with major players offering newer, faster, and more accurate technologies such as LC (Liquid Chromatography), HPLC (High Performance Liquid Chromatography), and ICP-MS (Inductively Coupled Plasma Mass Spectrometry).

Request for Sample Pages:

https://www.marketsandmarkets.com/requestsampleNew.asp?id=240885146

The increasing demand for dairy testing in Europe is driving the growth of the dairy testing market.

Europe has the world’s most stringent regulations for dairy testing, which undergo frequent updates and revisions. The world’s highest number of sample tests for both safety as well as quality are conducted in Europe. Strict compliance with MRLs and measures to prevent microbial contamination are preconditions for entering the European market. Exporters aiming to export milk and dairy products to the EU are required to follow a strict set of guidelines. They need to be export registered and listed with the EU (they require an AA or approved arrangement, which is a food safety document that describes how an organization manages its food safety and quality).

The increasing dairy trade between Europe and other regions is also driving the dairy testing market in this region as more dairy samples are being tested, both for import as well as export. Europe has one of the highest food safety standards in the world, due to which cases of milk fraud are rare. The Rapid Alert System for Food and Feed Safety provides information when risks to public health are detected in the food chain.

The key players in this market are SGS SA (Switzerland), Eurofins Scientific (Luxembourg), Intertek Group plc (UK), Bureau Veritas (France), ALS Limited (Australia).