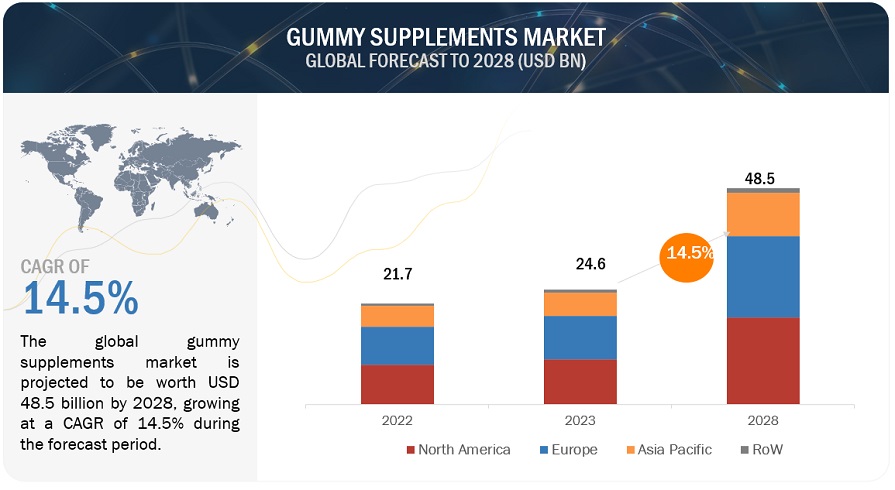

The global gummy supplements market is projected to reach USD 48.5 billion by 2028, at a CAGR of 14.5% over the forecast period. It is estimated to be valued at USD 24.6 billion in 2023. With the rise in the per capita income of the population, consumers are becoming more health-conscious and are seeking convenient and enjoyable ways to supplement their diets. Asia has a growing middle-class population, which is consequently increasing buying power worldwide. According to the OECD, the continent’s share of total middle-class consumer spending worldwide may escalate to 59% by 2030. Thus, the ascending middle-class population coupled with an increase in consumer spending capability is fueling the demand for convenient and tasty ways to supplement their diets, which in turn creates demand for sweet and chewy foods in the region.

Download PDF Brochure:

https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=39376426

The kids segment is projected to grow at the fastest rate among all the other end-users in the Gummy Supplements market in 2023

Gummy supplements have grown in popularity as a convenient way to provide kids with the vitamins and minerals they require without having to consume a range of foods. Gummy supplements meet the changing demands of children. They supply comprehensive nourishment in an uncomplicated way to the kids. They are superior to normal vitamins and more appealing to capture kids' interest and make them easier to ingest. Unlike tablets or pills, gummies are easier for kids to swallow since they are shaped like sweets. Additionally, according to the scientific article titled “Intraindividual double burden of overweight and micronutrient deficiencies or anemia among preschool children”, published in 2020, an estimated 29% of preschool children worldwide are vitamin A deficient, 18% are anemic, and 17% are at danger of low zinc intake. Thus, the soaring rates of micronutrient deficiencies can be reduced with the help of gummy supplements, augmenting its market growth.

Hypermarkets and Supermarkets are a Popular Places to Find Gummy Supplements

Hypermarkets and supermarkets typically offer a wide variety of gummy supplements, which are becoming increasingly popular due to their ease of consumption and pleasant taste. In hypermarkets and supermarkets, a range of gummy supplements targeted towards different age groups, genders, and health needs are made available. For example, there are gummy supplements for children that contain vitamins and minerals to support their growth and development, as well as gummy supplements for adults that may contain ingredients to support immune health, energy levels, or joint health.

Request Sample Pages:

https://www.marketsandmarkets.com/requestsampleNew.asp?id=39376426

US is one of the Major Market for Gummy Supplement in North America

The United States is one of the largest markets for gummy supplements in North America. The popularity of gummy supplements has increased significantly in recent years due to various factors, including the rising incidences of vitamin deficiencies, increasing demand for vitamin C and D supplements, and the need for personalized supplement solutions. Gummy supplements are a convenient and tasty way to supplement vitamin deficiencies and support health and wellness goals.

The key players in this market include GSK PLC. (UK), Church & Dwight CO., INC. (US), H&H Group (Hong Kong), Amway (US), Procaps Group(Luxembourg), The Clorox Company (US), Bayer AG (Germany), Haleon Group of Companies (UK), Catalent, Inc. (US), Nestle (Switzerland), Unilever (UK). in sugar substitutes market include International Flavors & Fragrances Inc. (US), ADM (US), Tate & Lyle (UK), Ingredion (US), and Cargill, Incorporated (US).