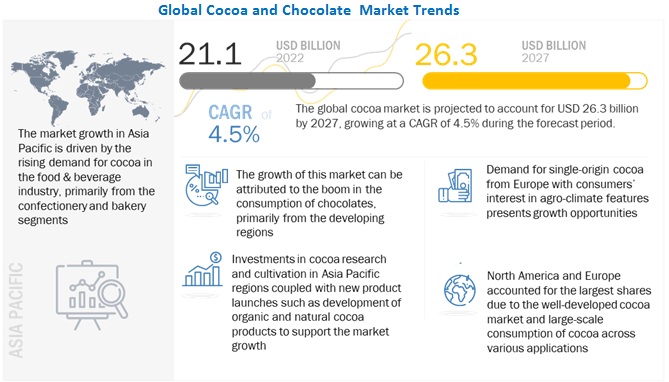

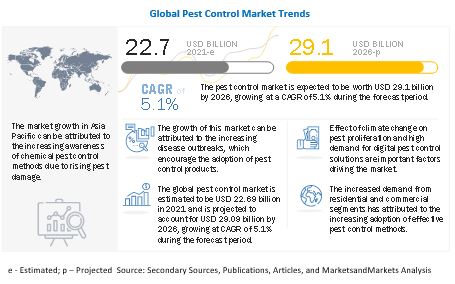

Pest

Control Market is projected to reach USD 29.1 billion by 2026,

recording a CAGR of 5.1% in terms of value. It is estimated to be valued at USD

22.7 billion in 2021. Pest management includes controlling infestations of

insects, animals, germs, or other organisms that damage property, destroy food

crops, and adversely affect the environment. Pest control eradicates or

minimizes a wide range of undesirable insects and other pests from areas used

for protective purposes, using chemicals, technologies, special equipment, and

other safety measures. Various chemical, mechanical, biological, and digital

solutions control different types of pests. Additionally, since pesticide

solutions are toxic, pest control technicians must be acquainted with safety

measures and proper usage.

Pest control is a prime aspect of

food safety across the global food supply chain. Automation and sustainable

approach have gained prominence within the supply chain. The number of service

providers in the pest control market has witnessed a significant increase in

recent years, driven by consumer demand for pest control services. Pest control

service providers have extended their available services from control,

extermination, and prevention to monitoring and suppression, with the help of

digital technologies and traps, including motion sensors and automated traps.

Companies such as Rentokil Initial PLC provide digital pest control systems

such as PestConnect range of IoT-enabled pest-control devices that allows the

monitoring of food processing facilities with maximum efficiency and minimum

effort. CRE8TEC Pte. Ltd., based in Singapore, Thailand, Indonesia, and Sri

Lanka, developed RATSENSE, an integrated infrared sensor-based system backed by

data analytics for pest control.

How

much will pest control market grow in 2023 and beyond?

Chemical treatment is the

mainstream method to reduce losses caused by insect pests. However, due to the

unwarranted side effects of chemicals, pest management relies on many other

options, including pesticides. Also, these chemicals generally do not

completely control insects across all growth stages. A combination of chemical,

mechanical, and biological control methods is required to control all stages of

insects' growth. Cockroaches are adaptable insects and can withstand diverse

climate conditions. They are also prevalent in regions with harsh climate

conditions, such as the Arctic Circle and desert regions, where they have

developed mechanisms to survive without water for a limited period. These pests

thrive in warm areas for food and are considered a nuisance in residential,

commercial & industrial areas. Control methods for cockroaches include

physical, biological, and chemical methods. Physical methods include traps,

heating of the infested area, vacuum, dust, and bait gels. Biological methods

include introducing predatory creatures such as frogs, turtles, mice, and

hedgehogs, which feed on cockroaches.

According to reports by major

service providers, Rentokil Initial Plc (UK) and Anticimex (Sweden), North

America occupies nearly 50% of the global pest control market. This is

attributed to the increase in the number of services available in the US and a

high rate of urbanization in the US and Canada. The strengthening of the

housing market and a steadily improving economy have led to increased

investments in both residential and commercial properties. These factors are

driving the market in the region.

Download PDF Brochure @

https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=144665518

Key Market

Players

The key players in this market include Bayer AG, Corteva Agriscience, BASF, Sumitomo Chemical Co., FMC Corporation, Syngenta AG, ADAMA, and Bell Laboratories. These players in this market are focusing on increasing their presence through agreements and collaborations. These companies have a strong presence in North America, Asia Pacific and Europe. They also have manufacturing facilities along with strong distribution networks across these regions.