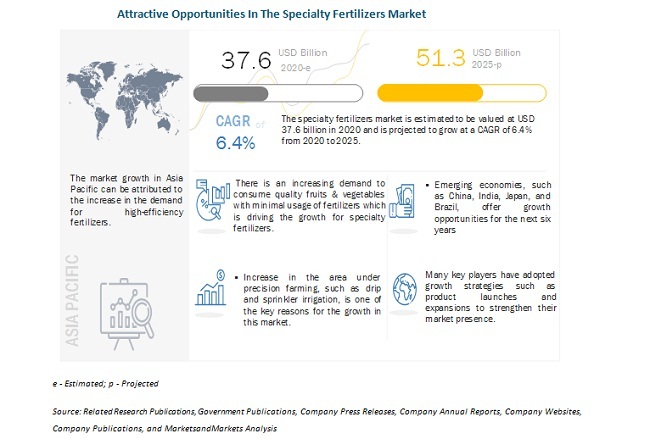

The report "Specialty Fertilizers Market by Type (UAN, CAN, MAP, Potassium Sulfate, and Potassium Nitrate), Application Method (Soil, Foliar, and Fertigation), Form (Dry and Liquid), Crop Type, Technology, and Region – Global Forecast to 2025", The global specialty fertilizers market is estimated to be valued at USD 37.6 billion in 2020 and is projected to reach a value of USD 51.3 billion by 2025, growing at a CAGR of 6.4% during the forecast period. Factors such as the rise in demand for high-efficiency fertilizers and an increase in crop varieties are projected to drive the growth of the specialty fertilizers market.

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=57479139

The urea-ammonium nitrate (UAN) segment is projected to be the largest segment in the specialty fertilizers market during the forecast period.

UAN is considered to be an excellent irrigation fertilizer for cereal production and irrigated plant cultivation. It is basically used before plowing the field, which helps in enhancing its degradation. Solutions of urea ammonium nitrate (UAN) are widely used as a source of nitrogen for plant nutrition. In combination with plant protective agents, it is mixed in the irrigation water for irrigated plant cultivation. Fluid fertilizers are blended together to meet the specific needs of a crop.

The fertigation segment is estimated to account for the largest market share, in terms of value, in 2020.

Fertigation is used in the fields of row crops, horticultural crops, fruit crops, vegetable crops, and ornamental & flowering crops. The fertigation method allows the homogenous application of liquid specialty fertilizers in an adequate amount to the wetted zone in the root development, where most of the active roots are concentrated, which helps in enhancing the efficiency of specialty fertilizers. This technique allows specialty fertilizers to be distributed evenly in irrigation. The application of specialty fertilizers through fertigation increases its efficiency by 10%–15%, as compared to conventional fertilization.

The coated & encapsulated segment is projected to witness the fastest growth, in terms of value, in the specialty fertilizers market, on the basis of technology, from 2016 to 2025.

Coated & encapsulated specialty fertilizers are conventional soluble fertilizer materials with increasingly available nutrients, which after granulation, prilling, or crystallization, are given a protective (water-insoluble) coating to control the water penetration, thereby affecting the rate of dissolution and nutrient release. To further reduce the total fertilizer costs, coated & encapsulated fertilizers are increasingly used with the blend of conventional fertilizers in different ratios. These fertilizers offer greater flexibility in determining the nutrient release pattern.

South America is projected to grow at the highest CAGR during the forecast period.

The market for specialty fertilizers in the South America region is projected to grow at the highest CAGR from 2020 to 2025. According to FAOSTAT, Brazil is the largest producer of agricultural products due to the availability of abundant land and rural labor force, followed by Argentina. The growth in South America is majorly attributed to the increase in the adoption of agrochemicals and advancements in farming techniques in Brazil and Argentina with distribution channels established by global agrochemical players. Due to these factors, the market in the South America region is projected to record the highest growth from 2020 to 2025.

This report includes a study on the marketing and development strategies, along with a study on the product portfolios of the leading companies operating in the liquid fertilizers market. It includes the profiles of leading companies, such as Nutrien, Ltd.(Canada), Yara International ASA (Norway), Israel Chemical Ltd. (Israel), K+S Aktiengesellschaft (Germany), Sociedad Química Y Minera De Chile (SQM) (Chile), The Mosaic Company (US), EuroChem Group (Switzerland), CF Industries Holdings, Inc. (US), OCP Group (Morocco), OCI Nitrogen (Netherlands), Wilbur-Ellis (US), Kugler (US), Haifa Group (Israel), COMPO Expert GmbH (Germany), AgroLiquid (US), Plant Food Company, Inc. (US), Coromandel International Ltd (India), and Deepak Fertilizers & Petrochemicals Corporation Ltd. (India), Nufarm (Australia), and Brandt (US).