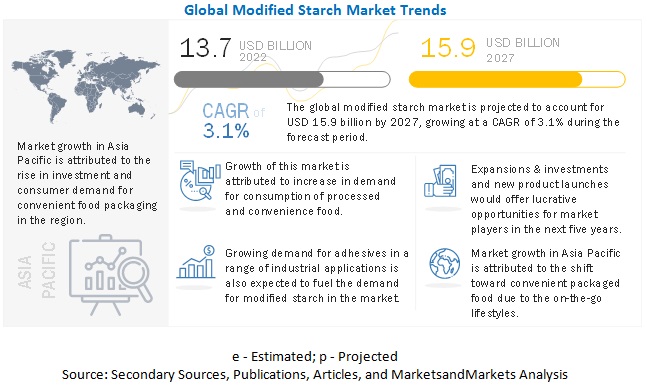

The global modified starch market is estimated to be valued at USD 13.7 billion in 2022. It is projected to reach USD 15.9 billion by 2027, recording a CAGR of 3.1% during the forecast period. Modified starches are manufactured from native starches. Various processing methods such as physical, enzymatic, wet & dry chemical processes, drum drying, and extrusion are used to produce different types of modified starch products. These processes are used to change the properties of native starch, such as its freeze-thaw stability, acid or alkali resistance, and shear stability to meet industrial requirements. Modified starches are used for functions such as thickening, stabilizing, binding, and emulsification. Apart from food products, it is also used in a wide range of non-food applications and the animal feed industry.

Download PDF Brochure @ https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=511

Key players in this market include Tate & Lyle (UK), Archer Daniel Midlands Company (US), Ingredion Incorporated (US), and Avebe (Netherlands)

Tate & Lyle is engaged in the manufacturing and marketing of food and industrial ingredients. It operates through three business segments, namely products, food & beverage solutions, and sucralose. These three business units are sustained by globalized support services, innovation & commercial development, and global operation groups. It serves a broad range of applications in food & packages, animal feed, industrial, pharmaceuticals & personal care. Starch products are offered through its primary products business segment. The company has expanded its global presence by acquiring new facilities. It continuously upgrades its portfolio by launching new products. It also focuses on the geographical expansion of production facilities and sales centers in countries such as China and Japan. In March 2020 Tate & Lyle launched its new line of clean-label starches for freeze-thaw stability. The new range of products was named CLARIA EVERLAST. The new clean-label starches would provide superior shelf stability. They included cook-ups and instant starches made from corn and tapioca starch.

Archer Daniel Midlands Company (ADM) is primarily engaged in the food processing and trading of commodities. It is one of the key players in the agricultural processing and food ingredient industry sectors. The company is involved in the trade, transportation, storage, and processing of a wide range of grains and commodities such as corn, oilseeds, wheat, and cocoa. It offers a range of modified starches through its carbohydrate solutions business segment. The company’s network spans more than 140 countries around the world. It operates globally through 272 processing plants and more than 470 crop procurement facilities, where cereal grains and oilseeds are processed into products used in the food, beverage, nutraceutical, industrial, and animal feed markets. The company operates its business through several subsidiaries such as Golden Peanut Company LLC (US), ADM Milling (US), ADM do Brasil Ltda (Brazil), WILD Flavors, Inc. (US), and ADM Hamburg AG (Germany).

Ingredion Incorporated (formerly Corn Products International, Inc.) is one of the leading providers of ingredient solutions to the food, beverage, brewing, health & nutrition, personal care, animal nutrition, and pharmaceutical industries, including various industrial sectors. The company processes cereals & grains, such as corn, tapioca, wheat, and potatoes. The products are used in processed food applications as fat replacing, gelling, glazing, stabilizing, or texturizing agents. The company is the leading manufacturer of corn-based starches and sweeteners in South America.

Ingredion operates through its processing and manufacturing facilities across North America, South America, Asia Pacific, Europe, the Middle East, and Africa. The company has 43 manufacturing facilities and operates globally through its subsidiaries, which include Corn Products Germany GmbH (Germany), Corn Products Espana Holding LLC (Spain), National Starch & Chemical (Thailand) Ltd), Ingredion Singapore Pte. Ltd. (Singapore), Ingredion Mexico, S.A. de C.V. (Mexico), and CP Ingredients India Private Limited (India).

Speak to Analyst @ https://www.marketsandmarkets.com/speaktoanalystNew.asp?id=511

In 2021, North America accounted for a market share of 21.6% in the global modified starch market. The North American modified starch market is completely driven by the US market. The US modified starch industry has witnessed technological advancement, which has increased its usage in various industries. In the US, modified starch is primarily used in canned soups and in blends where its thickening power is exploited, especially for fill viscosity. It is also used as a base for gelling agents in confections, for thickeners in products such as pastry and pie fillings, and in instant puddings. The growing trend of ready-to-eat meals and processed food is also driving the modified starch market in the region. Modified starch is frequently used in food applications due to its functional properties.